What is the current situation of PCB?

Oct 17, 2022

What is the current situation of PCB?

CINNO reported that demand for printed circuit boards (PCBs) froze sharply in the third quarter, and both major PCB manufacturers, copper foil substrates and upstream material manufacturers carried out strict destocking in the third quarter. Looking forward to the fourth quarter, as the economy and the attitude of customers have not changed significantly, PCB factories still give priority to reducing inventories. It is hoped that after the strict adjustment period in the third quarter, customers will be able to recover slightly in the fourth quarter. There is still more opportunity to grow.

From the performance point of view, according to CINNO Research statistics, benefiting from the strong demand of PCB downstream industries such as global automotive electronics, the performance of global top PCB companies continues to hit new highs. According to CINNO Research statistics, in the first half of 2022, the global top 10 companies' PCB product revenue scale is about 13.81 billion US dollars, a year-on-year increase of about 17.5%.

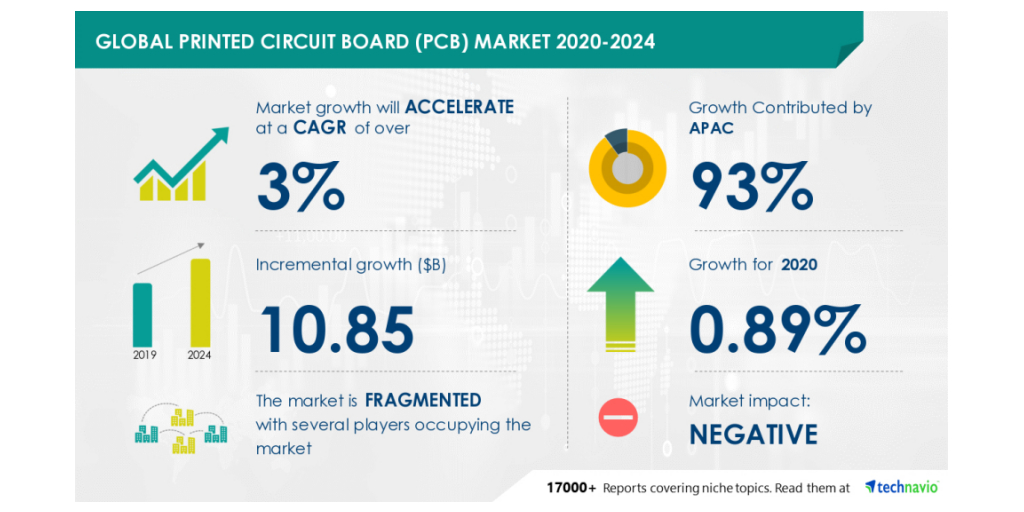

Avary Holding, the world's leading PCB company, has maintained continuous growth in consolidated revenue in the first nine months of this year. Avary Holding Holdings pointed out that despite the overall decline in smartphone sales in the first half of this year, the demand for high-end machines is still stable and rising, which can drive The company's communication products grew steadily. In addition, from the perspective of industry development in recent years, VR glasses and other consumer electronic products, 5G, AI, server equipment, automotive electronics, etc. will become new growth points in the PCB industry. According to Prismark's forecast in February 2022, the PCB industry is expected to grow at a growth rate of 5.2% in 2022, and will grow at a compound annual growth rate of 4.8% between 2023 and 2026. By 2026, the global PCB industry output value will reach 101.559 billion US dollars, The PCB industry still has a large market space.

On October 6, the IC carrier board factory Kinsus announced its September revenue. Benefiting from the traditional peak season effect and the still strong demand for ABF, Kinsus’s September revenue was NT$3.913 billion, a monthly increase of 1.13% and an annual increase of 16.73%. %, once again rewriting a new monthly high. The cumulative third-quarter revenue reached NT$11.544 billion, which also set a new single-quarter high.

It is reported that the demand for ABF carrier boards is still strong under the needs of high frequency, high speed and high speed computing. AI, IoT, HPC, machine learning, automotive electronics, 5G/6G infrastructure construction, etc., all have ABF related needs. Kinsus is also not pessimistic about the demand for ABF substrates next year, and the contribution of related products is expected to keep growing. The survey data of relevant institutions shows that although the global ABF substrate production capacity will be opened one after another from 2023 to 2025, the overall supply gap is still 11-13%, and it is estimated that the supply will remain in short supply until 2025.

In terms of terminal demand, shipments of consumer electronics such as mobile phones and PCs have declined since the beginning of this year compared with last year, which has also led to a weakening of the corresponding demand for PCB products. Looking ahead, the demand for downstream applications, mainly automotive electronics, will remain strong.

According to the data of the China Association of Automobile Manufacturers, the production and sales of new energy vehicles in my country from January to August 2022 will be 3.97 million and 3.86 million, respectively, an increase of 1.2 times and 1.1 times year-on-year. In terms of penetration rate, my country's new energy vehicles reached 27.9% in a single month in August, and the penetration rate from January to August in 2022 reached 22.9%, both hitting record highs. The substantial growth in the production and sales of new energy vehicles, the continuous improvement of market penetration, and the deep integration of vehicle electrification, intelligence, and networking will bring a broad market space for smart electric vehicle PCBs. The fourth quarter is the peak season for sales of new energy vehicles and consumer electronics products, and the corresponding demand for PCBs will also increase, and related PCB manufacturers will continue to benefit.

In addition, with the continuation of the Fed's monetary tightening policy, global commodity prices, especially copper prices, are likely to continue their downward trend. It is expected that the cost side of PCB companies is expected to continue to improve in the second half of 2022.

Recent Posts

October 26, 2016

The Most Successful Engineering Contractor

May 12, 2025

China PCB Drilling Routing machine Development

May 06, 2025

PCB Design Process and Key Points